India’s semiconductor market is set to soar from $38B in 2023 to $100‑110B by 2030 through bold policy, new fabs, skill-building & global partnerships

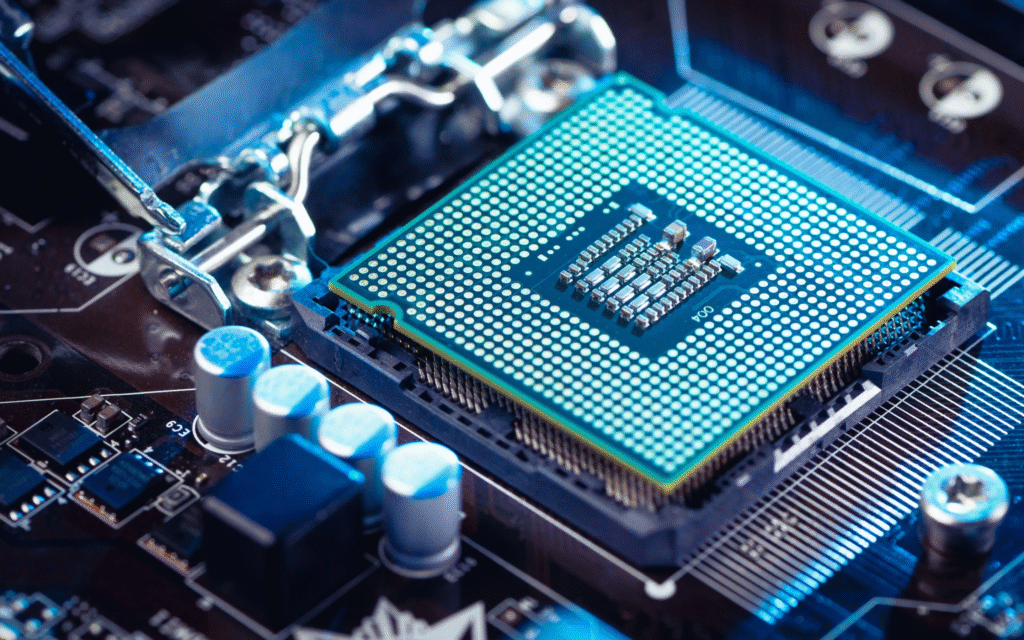

Imagine waiting for a new phone, only to hit a roadblock—no chips. In today’s world, every gadget, vehicle, even farm equipment, relies on semiconductors. That dependence creates vulnerability when supply chains choke. That’s the primary keyword: India semiconductor market—and why it matters more than ever.

India is no longer just consuming chips; it’s building them. With its domestic chip market growing from about $38 billion in 2023 to an estimated $100–110 billion by 2030, India is changing lanes fast India Briefing+13Rediff+13The Times of India+13dholera.io+3mint+3Orbit & Skyline Semiconductor Services+3Wikipedia+2techovedas+2MarkNtel Advisors+2. This isn’t hype—it’s a carefully crafted strategy powered by policy, partnerships, infrastructure, and innovation.

The Big Numbers: Semiconductor Market Growth

Current Estimate & Forecast

- In 2023: India’s semiconductor market was worth around $38 billion

- By 2024–25: it rose to $45–50 billion

- And by 2030: projected to hit $100–110 billion, implying a 13–16% CAGR MarkNtel Advisors+3techovedas+3mint+3

That’s nearly a threefold rise in just seven years — a digital leap powered by smartphones, EVs, telecom expansion, and a booming services sector.

Key takeaway: India’s semiconductor market is set for explosive, policy-driven growth—tripling in value by 2030.

What’s Fueling the Boom?

📌 India Semiconductor Mission (ISM) and Incentives

Launched in December 2021 with a government outlay of ₹76,000 crore (~US $10 billion), ISM offers Production‑Linked Incentives (PLI) and Design‑Linked Incentives (DLI) to attract fabs, display technology plants, packaging units, and chip design startups fiinews.com+1Wikipedia+1mint+1Orbit & Skyline Semiconductor Services+1.

- PLI supports fabrication & testing units

- DLI backs domestic chip design, already funding dozens of startups

- Scheme also has local value‑addition targets: 25% by 2026, 40% by 2030 hcl.com+1Wikipedia+1affairscloud.com+15IndBiz | Economic Diplomacy Division+15The Times of India+15

Global Collaborations: iCET & Beyond

Bilateral frameworks such as the U.S.–India Initiative on Critical and Emerging Technology (iCET) deepen cooperation in semiconductors, AI, quantum computing and more Wikipedia. These align with India’s ambition to integrate into global tech supply chains.

Key takeaway: Robust incentives + global partnerships provide financial impetus and technical know‑how for India’s chip ambitions.

People & Plant – Building the Ecosystem

🏗️ Fab and ATMP Facilities Underway

India currently has six semiconductor units approved under ISM, all in various stages of setup or construction pib.gov.in+5India Briefing+5economictimes.indiatimes.com+5:

- HCL–Foxconn JV, near Jewar Airport in Uttar Pradesh: ₹3,706 crore (~US $435 M) OSAT/fab unit, capacity: 20,000 wafers/month → ~36 million display driver chips/month. Commercial output expected by 2027 techcrunch.com+15hcl.com+15affairscloud.com+15India Briefing+3evertiq.com+3Reuters+3

- Tata Electronics & PSMC in Dholera, Gujarat: ₹91,000 crore fab (US $10–11 billion), capacity ~3 billion chips/year, target operations by 2027 MarkNtel Advisors+3Communications Today+3techovedas+3

- Tata Semiconductor Assembly & Test (TSAT) in Assam (Jagiroad): ₹27,000 crore ATMP unit, capable of ~48 million chips/day, expected online mid‑2025 India Briefing+2Wikipedia+2Wikipedia+2

- Kaynes Semicon plant in Sanand: ₹3,307 crore (~6.3 million/day) facility approved September 2024 Wikipedia

- Micron ATMP facility in Gujarat: approved SEZ with US $1.5 billion investment plans India Briefing

- Another CG Power/Renesas unit in Sanand (~₹7,600 crore capacity) contributing millions of chips daily Wikipedia

🧪 Homegrown Design: Talent & Research

- Bharat Semiconductor Research Centre (BSRC) at IIT Madras is India’s MIT‑style focus centre for chip R&D, tied to modernizing SCL in Mohali with a $2 billion plan Wikipedia

- SHAKTI microprocessor & IRIS aerospace chip, developed by IIT Madras & ISRO using 180 nm node, packaged and assembled entirely in India in early 2025 Wikipedia

- Over 85,000 engineers to be trained under C2S (Chips‑to‑Startup), chip design, VLSI, systems engineering programs across top universities

Key takeaway: India’s chip dream is built on physical fabs, academic research centres, and a massive talent pipeline for design and fabrication.

Why This Matters Globally & Locally

🧭 Reducing Global Supply Risk

Much of the world’s semiconductors now are made in Taiwan, South Korea, Japan, China, and the U.S. India offers an alternate, reliable source—boosting resilience for global supply chains and strengthening tech sovereignty ETGovernment.comThe Times of India.

📌 Strategic Autonomy & National Security

As ASSOCHAM’s Sunil Gupta put it, “Digital sovereignty begins at the chip level.” India’s ownership over chip design and production underpins secure layers of technology from OS to data to apps The Times of IndiaThe Times of India.

🚀 Economic Growth & Job Creation

These fabs and R&D hubs will create thousands of direct jobs and many more indirect roles in MSMEs, logistics, chemicals, services, equipment manufacturing, and semiconductor startups. States like UP, Gujarat, and Assam are set to become tech manufacturing hubs WikipediaThe Times of India.

Key takeaway: India’s semiconductor push is a strategic pivot for economic resilience, security and export strength.

Section Summary

| Section | Key Message |

| Market Growth | India’s chip market is slated to nearly triple by 2030. |

| Catalysts | ISM incentives + global partnerships fuel this journey. |

| Infrastructure | At least six major chip facilities backed by robust design efforts. |

| Strategic Impact | Enhancing supply chain resilience, sovereignty & economic uplift. |

Real-World Impact: What This Means in Everyday Life

Picture this: next time India’s Chandrayaan or defence sectors need custom chips, it won’t rely on imports. The IRIS chip, used in ISRO’s space mission systems, is proof of India’s homegrown competence in action mint+4Orbit & Skyline Semiconductor Services+4ETGovernment.com+4. Meanwhile:

- Smart devices, EVs, telecom gear will increasingly come with locally made semiconductors

- Startups designing SoCs will hit tape‑out from India‑based fabs

- MSMEs will manufacture essential equipment parts, materials, gases, chemicals

- And young engineers will join university‑industry programs geared for chip design and VLSI careers

Analogy: It’s like building the entire “chip bakery”—from grain (materials) to flour (components), recipes (design), ovens (fabs), and loaves (finished chips)—all inside India rather than importing loaves.

Challenges to Watch

Even with traction, some hurdles remain:

- Timeline pressure: Major factories aren’t online until 2026–27

- High capital intensity: Fabs cost billions under unpredictable markets

- Supply-side scaling: Local materials & gas providers must catch up to fabs’ pace

- Global competition: Competing with entrenched players like Taiwan & Korea

But India’s diverse ecosystem—from MSMEs to research centres—is plugging those gaps with financial incentives and global tech tie‑ups.

Key takeaway: Challenges exist, but coordinated action and policy momentum are cutting them down steadily.

Final Thoughts: India’s Semiconductor Vision by 2030

In just a few years, India is moving from technological dependence to self-reliant innovation. By 2030, the nation aims not only to meet its internal chip needs but also to emerge as a serious exporter and global technology partner.The market forecast of $100–110 billion isn’t just a number—it’s a roadmap built on policy, infrastructure, talent, and strategic partnerships. India is baking its chip ecosystem from the ground up, guided by skill, scale, and vision.

What is the size of India’s semiconductor market today?

In 2023 it was about $38 billion, rising to $45–50 billion by 2024–25.

What are the biggest challenges for India’s chip ambitions?

Long factory lead times, high capital needs, and scaling domestic supply chains remain hurdles.

What will India’s semiconductor market be worth by 2030?

Forecasts point to $100–110 billion by 2030 driven by public‑private investment.

Where are India’s major chip fabs being built?

Key locations include Jewar (UP), Dholera (Gujarat), Sanand (Gujarat) and Jagiroad (Assam)