Have you ever wanted to buy a solid company’s share but felt the price was just too high to dip your toes in? What if that cost barrier was sliced down, making ownership more accessible? That’s exactly what’s happening with Adani Power stock split.

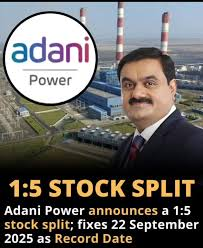

On September 22, 2025, Adani Power will trade ex-split after executing a 1:5 split, turning each share of face value ₹10 into five shares of face value ₹2. Sounds technical? It is — but it could matter a lot for your portfolio, especially if you’re someone who watches the small-print for big opportunities.

In this post, we’ll unpack what the split means, why Adani Power did it, how the market is responding, and how you (as a retail or institutional investor) might benefit — or risk missing out.

Body

1. What exactly is a Stock Split — Simplified

Basic Definition & Mechanics

- A stock split means each existing share is divided into multiple new shares; total number of shares increases but the company’s market cap stays the same.

- Here, Adani Power is doing a 1:5 split: 1 share → 5 shares, changing face value from ₹10 → ₹2. MoneyControl+4Business Today+4mint+4

- Record date is Sept 22, 2025: whoever holds the shares as of this date (or more precisely, bought prior to that as per T+1 rules) gets the split shares. The Economic Times+1

Why Companies Split Shares

Here are typical reasons, with how they apply to Adani Power:

| Reason | What it does | Adani Power’s case |

|---|---|---|

| Make share price more “affordable” for small/retail investors | Lower per-share price (face value) can psychologically encourage buying | Adani Power aims to improve accessibility & liquidity. Business Today+1 |

| Increase liquidity & trading volume | More affordable slices could lead to more trades, tighter spreads | Expected in this split too. Business Today+1 |

| Signal of confidence | When a company proposes a split, often viewed as having stable or improving fundamentals | In tandem with positive analyst ratings and SEBI clearances. Goodreturns+3scanx.trade+3The Economic Times+3 |

Key takeaway: A stock split doesn’t change what the company owns, its profits, or its obligations — it changes how the pie is sliced.

2. The Specifics: What Adani Power’s Split Means

Key Dates & Details

- Record Date: Monday, Sept 22, 2025 mint+1

- Last Day to Buy to Be Eligible: Friday, Sept 19, 2025, since India follows T+1 settlement. Shares bought on Sept 22 during trading will likely not get the split. The Economic Times+1

- Split Ratio / Face Value Change: Each fully paid-up ₹10 share → five shares of ₹2 each. Business Today+2Elite Wealth+2

What Doesn’t Change

- Total value of your investment remains same immediately after split (market cap unchanged).

- Company operations, financials, products/services, revenue, profit remain same.

- Dividends, EPS calculations, etc., are adjusted proportionately.

What Changes (and What to Watch)

- Per share price will drop (roughly divided by 5), which might attract more buyers.

- Per share metrics (EPS, book value, etc.) will also adjust accordingly.

- Liquidity expected to improve.

- Trading behaviour may see more volatility around ex-split date.

Key takeaway: The split changes share count and per-share metrics; it doesn’t change the company’s fundamental health.

3. Market Reaction & What’s Fueling the Surge

Adani Power isn’t doing this split in a vacuum — several catalysts are driving investor excitement.

- Surge in Share Price Before Split: Just before the split, the price ran up ~13-14%. For example, on the Friday before record date, shares closed at ~₹716.10. mint+2The Economic Times+2

- Returns Over Time: In the past 1 month, ~20% gain; over 6 months ~37.16%. And longer term it’s been a multibagger with huge returns. mint

- Regulatory Overhang Cleared: SEBI dismissed parts of Hindenburg Research’s allegations, which had weighed on the Adani Group’s stocks. That improved investor confidence. Business Today+2mint+2

- Analyst Ratings: Morgan Stanley initiated coverage with an “Overweight” rating, seeing potential upside (₹ 818 price target). The Economic Times+1

Risks & Things to Be Cautious About

- Price drop risk: post ex-split, share price will drop numerically (but value is same) — some investors misinterpret this, panicking. Business Today

- Volatility around ex-split date: both because of speculation, and because some investors may buy just to be eligible, then sell.

- Fundamentals still matter: recent financials show some pressure (e.g. revenue decline YoY). Strong returns don’t always guarantee future growth. Screener+1

Key takeaway: The split combined with clear regulatory environment and strong analyst support is fueling a very positive sentiment. But investors need to stay grounded in fundamentals, not just rides on hype.

4. How Retail & Institutional Investors Can Make the Most

Here are actionable ideas, mistakes to avoid, and things to consider — because you won’t benefit from the split if you misplay timing or expectations.

What You Can Do

| Strategy | What to Consider | Example |

|---|---|---|

| Buying before record date | Needed to qualify for split shares. But buy only after assessing risk. | Purchase by Sept 19, 2025 to be eligible. The Economic Times |

| Using the drop wisely | After ex-split, price drops; could be opportunity to buy if you believe in long term. | If you miss eligibility, still consider post-split price levels. |

| Monitoring analyst target & business plans | What are future capacity additions? What’s demand outlook? | Analysts see growth, but recent revenue slide must be watched. |

| Avoiding speculative traps | Don’t buy just for split; check leverage, debt, regulatory risks. | While price action is good, there are concerns in power demand fluctuations. |

Common Mistakes

- Buying on record date thinking you’ll get split shares — T+1 rules mean order must settle. NDTV Profit

- Confusing split with bonus shares or dividends — they’re very different. In bonus issue, face value stays same; split changes it. Business Today

- Expecting fundamental change — split doesn’t make the business stronger by itself. It’s cosmetic in many ways.

Key takeaway: Smart timing + understanding what changes vs what stays = best position to benefit. Hype alone can hurt.

5. Broader Implications & What It Says About the Market

Adani Power’s stock split is more than just a corporate action for one company — it reflects certain trends and might indicate bigger shifts.

Signals in the Market

- Companies are recognizing retail investors’ power — making things more affordable signals inclusion.

- Clean regulatory environment matters: investors responded strongly to SEBI’s clarity on Hindenburg allegations. Reuters+1

- Sense of optimism in power/utilities sector: demand, capacity, energy transition (though coal remains central for now).

Comparisons & Lessons from Other Splits

- Like Adani Enterprises and Adani Ports in past (they had splits), but this is Adani Power’s first such action. Business Today+1

- Global parallels: tech stocks often split to bring down per-share price; Indian markets are increasingly seeing that too.

Key takeaway: This isn’t just about one company — it points to a maturing equity market, where share price psychology, regulatory trust, and retail participation are growing in importance.

What to Remember

“Splitting shares doesn’t split value — but it can split barriers to entry.”

- Stock split just changes number of shares and face value; it doesn’t change company metrics.

- For Adani Power: ex-split date Sept 22, last buy to qualify is Sept 19.

- Market sentiment is strong because split + regulatory clarity + bullish analyst ratings are aligning.

Conclusion & Call to Action

Adani Power’s 1:5 split opens up a fascinating moment. For many retail investors, this could lower the entry cost. For others, it signals confidence from management, combined with clean regulatory skies, to seek long-term value.

But a note of caution: don’t ride blindly on momentum. Look into the recent financials, demand trends for electricity, and how the power sector is evolving (fuel costs, policy, environment).

What will you do? Will you buy before Sept 19 to get split shares? Or wait for post-split price correction? Share your strategy — I’d love to hear how you’re thinking about it.