Have you ever watched the value of someone else’s investment grow and thought: “Could I do that too?” Maybe you scroll through news of IPOs going bonkers, ETFs making returns, or dividends dropping into certain accounts—and wonder if you’re missing out. If you want to invest in stocks (and ETFs, IPOs), but feel overwhelmed by all the terms and risks, you’re not alone. This guide is for you—someone who wants to start smart, avoid rookie mistakes, and build real wealth over time.

Understanding the Basics: Stocks, ETFs, and IPOs

You can’t build without a foundation. Think of this like learning the rules before playing the game.

A stock, or share, gives you partial ownership of a company. If the company grows, your share’s value can rise. If it struggles, the opposite happens. Stocks trade on the secondary market—like NSE and BSE in India. To hold them, you need a Demat account, which keeps shares in electronic form, and a trading account to execute buy and sell orders. Both accounts are linked to your bank.

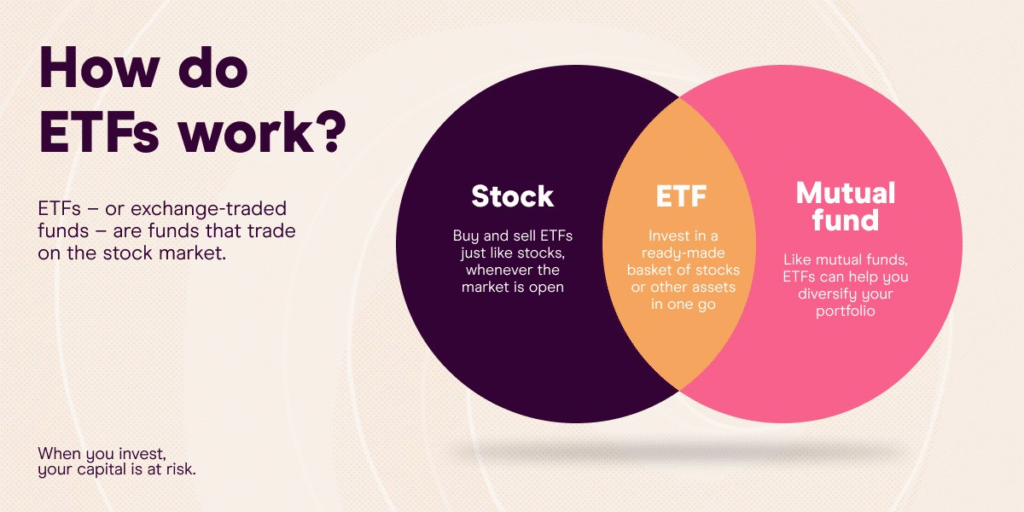

An ETF, or Exchange-Traded Fund, is like a basket of many stocks (or other assets) that you can buy in one go. It’s similar to buying a sampler platter instead of a single dish. ETFs give you instant diversification, often come with lower fees than mutual funds, and are transparently traded on exchanges. If the stocks inside pay dividends, you’ll receive a share too.

An IPO, or Initial Public Offering, is when a private company offers its shares to the public for the first time. Investors get the chance to buy before those shares move into open trading. IPOs are exciting because of growth potential—but also risky, as valuations can be high and company track records limited.

Key takeaway: Understand the instruments before investing—stocks offer ownership, ETFs offer diversification, and IPOs offer early access but higher risk.

How to Start Investing in India

Let’s get down to the “doing” part. A clear plan helps you avoid confusion and impulsive mistakes.

The first step is setting your goals and defining your risk appetite. Are you investing for short-term goals like a car, or long-term goals like retirement? Can you handle a 10% dip, or would a 50% loss send you into panic? Knowing this keeps your strategy aligned with your personality.

Next, open the necessary accounts. In India, you need both a Demat account and a trading account with a SEBI-registered broker. Completing KYC requires PAN, Aadhaar, and proof of your bank account.

Once ready, start researching. For stocks, look at fundamentals like earnings, debt, and sector performance. For ETFs, check their expense ratio, what index they track, and whether they distribute dividends. For IPOs, read the red herring prospectus to understand valuation, promoter background, and reasons for going public.

Placing orders comes next. For stocks, you can use market orders to buy immediately or limit orders to wait for your price. For IPOs, applications are made during the subscription window, and allotment may happen via lottery if demand is high.

Finally, monitor and adjust. Track your portfolio’s performance, news updates, and sector trends. Rebalance when one stock or sector grows disproportionately large.

Key takeaway: Investing is not a one-time decision but an ongoing process—set goals, open accounts, research carefully, invest, and review regularly.

Dividends and Returns: What Actually Adds Up

Many investors only focus on share price growth, but real wealth often comes from a mix of price appreciation and dividends.

Dividends are portions of company profits shared with shareholders, often annually or quarterly. Some firms never distribute dividends, choosing instead to reinvest profits into growth. That can be equally attractive if you’re seeking capital appreciation.

ETFs that hold dividend-paying stocks either pass those payments directly to you or reinvest them within the fund. If you want steady income—say, monthly or quarterly—choose ETFs that distribute dividends. If you prefer compounding wealth, pick accumulating ones that reinvest automatically.

For example, if you buy a stock at ₹100, and after three years it rises to ₹130, that’s a 30% price gain. If, during the same period, the company also pays ₹10 in dividends, your total return is 40%.

Key takeaway: Dividends are the cherry on top of price appreciation. Reinvested wisely, they can significantly boost your long-term returns.

Risk, Mistakes, and How to Avoid Them

Investing isn’t just about chasing returns—it’s about survival and avoiding devastating losses.

Some common risks include market risk from economic downturns, company-specific risk like poor management decisions, valuation risk from overpaying for hyped stocks, liquidity risk where you can’t easily buy or sell, and regulatory risk due to sudden tax or SEBI rule changes.

Beginners often make predictable mistakes: investing too heavily in one stock, chasing IPO hype without research, ignoring fees, skipping diversification, or panicking during market dips.

You can mitigate these risks by diversifying across sectors and instruments, using SIPs to average costs, and only investing money you can spare for the long term. Keeping some funds in safe assets like bonds or fixed deposits adds a cushion for emergencies.

Key takeaway: Avoiding big mistakes matters more than finding the next “multibagger.” Discipline and diversification are your safety nets.

Real-Life Examples and Lessons

Rahul, a 30-year-old from Hyderabad, sets aside ₹5,000 a month. He splits it between a Nifty50 ETF, a carefully chosen growth stock, and a small reserve in cash. Over time, his ETF provides steady growth and dividends, his stock adds higher upside (with volatility), and the cash helps him stay calm during market dips.

IPO history also teaches valuable lessons. Some strong IPOs of companies with robust fundamentals rewarded investors handsomely after listing. But others, driven only by hype, sank in value after listing day. The lesson is clear: IPOs can be rewarding, but they’re never guaranteed gold.

Key takeaway: Real wealth comes from consistent, disciplined investing—not one lucky hit.

Tracking and Measuring Performance

To know whether you’re doing well, you must measure results correctly. Look at absolute returns (gain or loss compared to cost), annualized returns (to compare across years), dividend yield (income relative to stock price), and expense ratios (especially for ETFs).

Also, consider real returns after adjusting for inflation. Compare your portfolio with benchmarks like Nifty50 or Sensex to see if you’re beating the market or lagging behind.

Key takeaway: Numbers don’t lie—track both growth and income, and always compare against inflation and benchmarks.

Conclusion

Investing in stocks, ETFs, and IPOs isn’t a privilege reserved for insiders. With clarity, purpose, and discipline, it’s accessible to anyone in India today. The journey will have ups and downs, but by learning continuously, diversifying wisely, and avoiding panic, you tilt the odds in your favor.

Are you ready to take the first step? Pick one stock or ETF, invest a small amount, and track it for a month. What surprised you? Share your experience—I’d love to hear what you discovered.

Leave a Reply