Caught off guard during a trade? Learn how Indian traders can manage emotions, avoid panic, and stick to their trading plan during market chaos.

Caught off guard during a trade? You’re not alone.

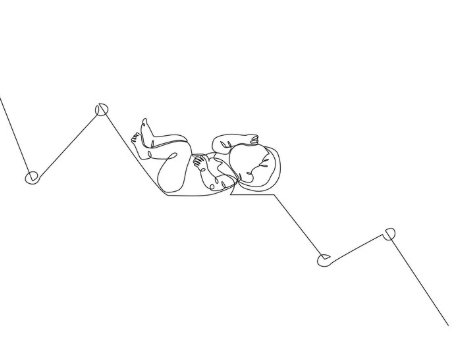

Imagine this: You’ve crafted a trading plan. You’ve done the research, waited for the right setup, and finally entered the trade. But within minutes, the market flips. You freeze. Your heart pounds. Your mouse hovers over the “exit” button but your brain is screaming confusion. Welcome to the panic zone.

If you’re a beginner or even a mid-level trader in India, you’ve likely faced this. That intense moment where the market doesn’t follow the script and emotions hijack your rational brain. One wrong move here—and the consequences aren’t just financial, they’re emotional too.

In this blog, I’ll mentor you through why you panic, what your brain is doing in that moment, and more importantly, how to prepare for and overcome this chaos with grace.

🤯 Why You Panic: Your Brain’s Primitive Wiring

Let’s get real—trading is a psychological battlefield.When a trade goes south unexpectedly, your brain doesn’t just get disappointed—it activates your fight-or-flight response.

This is what happens:

- Your amygdala (the brain’s fear center) sounds the alarm

- Cortisol floods your body

- Logical thinking shuts down

- You either freeze, panic sell, or irrationally double down

You’re no longer trading. You’re surviving.

🧠 Indian Analogy:

Think of it like driving in Delhi traffic. You’re cruising along calmly, and suddenly, a biker swerves in front of you. Your instinct is to brake hard or yell. Trading is no different. But you can’t yell at the market.

That’s why emotional control is not optional, it’s a skill.

📋 Build a Trading Plan That Prepares for Chaos

The #1 cause of panic? Being unprepared.

Most beginner traders say:

“But I had a plan!”

But was it detailed enough?

🎯 A Real Trading Plan Should Include:

- Entry criteria (not just vague intuition)

- Stop-loss and target levels

- Exit triggers if things go wrong

- Volatility plan (What will you do if Nifty drops 200 points instantly?)

- Pre-written rules to override emotion

📌 Pro Tip:

Write your plan before the trade. Put it in writing. Stick it near your desk. When panic hits, your brain won’t think straight—let your written plan take over.

🧠 What You Should Remember:

- Panic thrives in ambiguity

- Clarity kills confusion

- Don’t “think on your feet” during chaos—follow pre-decided steps

🛑 Risk What You Can Emotionally Handle

Emotional trading often begins with emotional capital.

If you’re risking more than you can afford to lose, you’ve already lost your mental edge.

Let’s break this down:

❌ What Not to Do:

- Don’t trade with rent money

- Don’t go “all in” to recover losses

- Don’t take oversized positions “because the setup looks perfect”

✅ What To Do:

- Stick to the 1–2% rule per trade

- Use position sizing that allows you to sleep well at night

- Use contingency planning: “If X goes wrong, I’ll do Y”

💬 Desi Analogy:

You wouldn’t bet your entire Diwali bonus on one IPL match. Then why do that in a volatile market?

When you manage risk properly, your brain feels safe, and your actions become strategic—not impulsive.

⚠️ Recognize the Early Signs of a Panic Trade

Sometimes the panic isn’t obvious. It creeps in.

🚨 Emotional Red Flags Before You Act Rashly:

- Increased heart rate

- Rushing to “fix” a bad trade

- Changing stop-loss mid-trade

- Avoiding the trading screen

- Getting angry or overconfident

📌 Mindset Shift:

The moment you feel like rushing—pause.

Breathe. Step away for 60 seconds. Ask:

“Am I reacting or responding?”

🎯 Quick Exercise:

Name the emotion → Acknowledge it → Return to the plan.

🧘♂️ Train for Chaos Before It Happens

Pilots use simulators. Cricketers practice under pressure.

Why should traders be different?

You can’t think clearly in panic unless you’ve trained for uncertainty.

🛠️ Practice Scenarios You Must Simulate:

- Market gaps against your position

- Slippage on stop-loss

- Fake breakouts or whipsaws

- Sudden news announcements

- Internet/power failures mid-trade

💡 Case Study:

Ravi, a 34-year-old bank employee turned swing trader, used to panic exit trades at the first sign of red. Once he started journaling mock scenarios and pre-planning responses, he cut his emotional trades by 70%.

Simulation trains your brain to expect the unexpected.

💪 Mindset Is Your Edge in Panic

Your belief system influences your response.

Fixed Mindset vs Growth Mindset in Panic:

| Situation | Fixed Mindset | Growth Mindset |

| Stop-loss hit | “I failed” | “I followed the plan” |

| Price reverses suddenly | “Market is against me” | “Unexpected moves happen” |

| Emotional reaction | “I’m not made for this” | “I need to work on my discipline” |

📌 Shift the narrative:

You are not your trade. A bad trade isn’t a bad trader.

View each panic moment as a lesson, not a life sentence.

🔑 Quick Takeaways: Trade with Calm, Not Chaos

- Expect adverse events. Don’t assume perfection.

- Detail your plan so you don’t rely on emotions mid-trade

- Manage risk like your sanity depends on it (because it does)

- Train for volatility like an athlete preps for pressure

- Detach self-worth from market moves

📣 Call to Action:

Have you ever faced a moment of panic while trading? How did you handle it—or wish you had?

Drop your story in the comments or share this with a fellow trader who could use some emotional clarity today.

Let’s build a community of calm, calculated traders—not emotional reactors.

🏁 Final Word: Don’t Let the Market Control You

The stock market will surprise you. That’s a guarantee.

But whether you panic or perform—that’s up to you.

When you trade with awareness, preparation, and emotional detachment, you stop being a victim of chaos and start becoming a master of calm.So the next time you’re caught off guard during a trade—you’ll smile, take a breath, and say:

“I’ve trained for this.”

Why do I panic during a trade even with a plan?

Because your brain is wired for survival. When the plan faces stress, emotion overrides logic.

How do I stay calm in volatile market conditions?

Prepare for volatility. Practice risk control. Stick to a written trading plan.

What is the best way to avoid emotional trading?

Have a detailed trading system and manage your position size emotionally—not just technically.

Should I stop trading if I panic often?

Not necessarily. Take a break, assess your mindset, and work on emotional control before re-entering.

Can I train myself to avoid panic in trading?

Yes. Through journaling, simulation, risk management, and mindset work, emotional control improves with time.