US Stock Market LIVE Updates: Dow falls by around 600 points due to dismal jobs data – A clear-sounding, expert-led analysis of the July jobs shock, market impact, Fed, tariffs, and what India investors should learn.

Have you ever felt the stomach‑twist of reading that markets cratered again? That’s exactly what happened when the Dow Jones Industrial Average plunged more than 600 points on August 1, 2025. The headline-grabbing trigger: weak July jobs data combined with a fresh wave of Trump’s trade tariffs. As someone deeply tracking market cycles—and as an Indian investor inferring global signals—I want to break it all down.

Right upfront: US Stock Market LIVE Updates about the Dow’s fall deserve more than a cursory read. Let’s step beyond noise and raw numbers into what really matters—for your portfolio, for the Fed’s next move, and potential ripple effects in India.

🧾July Jobs Report Shocks Wall Street

📉 The Bureau of Labor Statistics stunned markets by reporting just 73,000 new non‑farm jobs in July, far below the ~100,000 economists expected The Washington Post+15Barron’s+15FXEmpire+15The Times of IndiaThe Guardian.

Prior gains for May and June were slashed by 258,000 jobs combined, turning earlier optimism into cold facts Axios+5AP News+5The Economic Times+5. The unemployment rate nudged upward to 4.2%, and labor force participation fell slightly The Economic Times+3Axios+3Glassdoor+3.

Why it matters:

- After months of steady hiring, the labor market hit its weakest non‑pandemic stretch since 2010. Some analysts estimate hiring averaged only around 35,000 jobs/month over the past three months ft.com+8Axios+8Quartz+8.

- Economists flagged this as a real red flag: firms pulled back on hiring even without mass layoffs, especially in manufacturing and tech sectors.

Key Takeaway

The slowdown wasn’t subtle—it rewrote the narrative. Hiring has hit stall speed, and downward revisions exposed how fragile data-driven confidence had been.

🧾Market Fallout: Dow Plunge & Tech Sell-Off

In reaction, U.S. equity markets collapsed:

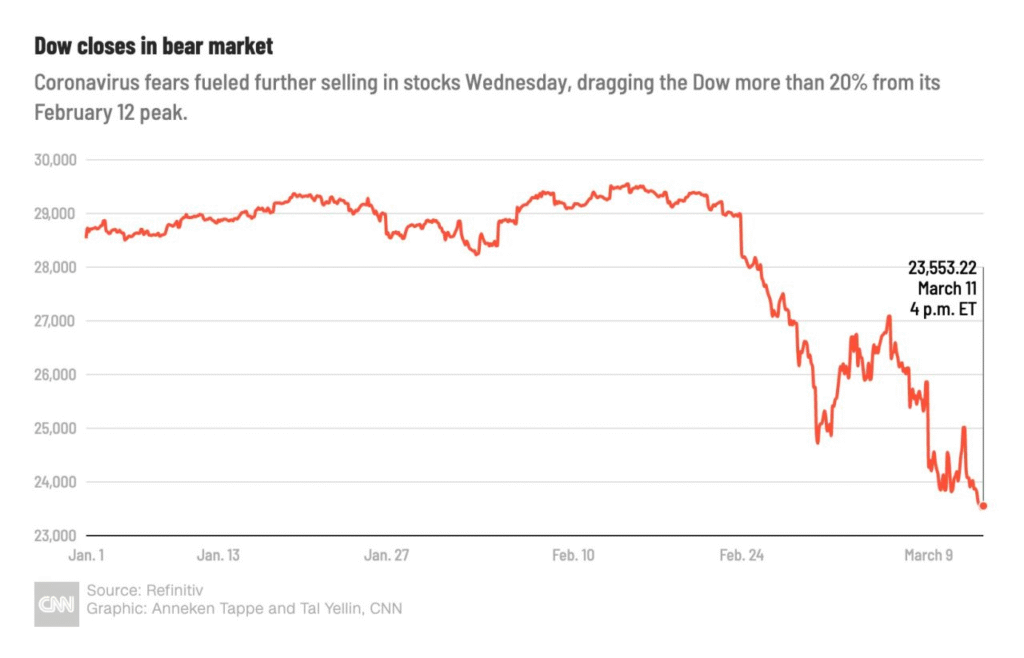

- Dow Jones fell ~1.4%, losing 630+ points (some reports stated a 542‑point drop by close) The Washington Post+1Vanity Fair+1Quartz+13Yahoo Finance+13Barron’s+13Wall Street Journal+1New York Post+1.

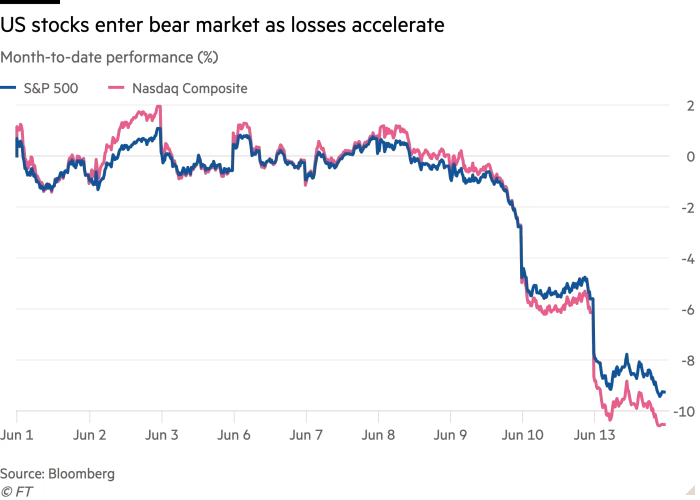

- S&P 500 slid ~1.7%, its steepest drop since June Yahoo Finance+2Barron’s+2The Times of India+2.

- Nasdaq sank ~2.3%, hitting two‑month lows on tech weakness ReutersYahoo Finance.

💡 Over $1 trillion in market value was wiped out in a single day ReutersThe Times of India. Amazon, Apple, Nvidia, Meta, Alphabet all saw losses in the 2–8% range. Defensive sectors—healthcare and consumer staples—held up slightly by contrast.

Analogy: It was like a traffic jam triggered by one broken signal—strain builds invisibly, and when numbers break, the chaos spreads in seconds.

Key Takeaway

This was not a routine pullback—it was a sharp shift in investor sentiment, with tech bears leading and defensive assets limping by.

🧾Tariff Shock: Trump’s Escalation on August 7

Just as markets were digesting labor weakness, President Trump unveiled steep new tariffs on imports from 66–70 countries, effective August 7 AP News.

Tariffs range from 10% up to 41%, affecting countries such as India (25%), Canada (35%), Taiwan (20%) and Syria (41%) among others New York Post.

Why it matters:

- These are broad-based hikes, not limited to a few nations—pinging major partners across sectors.

- For U.S. multinationals reliant on global inputs (and Indian exporters too), costs are likely to rise sharply.

- Global firms began reevaluating supply chains, and bond markets tumbled as inflation fears resurged.

Example for India: Imagine your auto component supplier suddenly facing a 25% duty—profit can get squeezed fast.

Key Takeaway

Tariffs added a policy threat layer to already weak data—fueling fear that trade policy, not economics, might derail growth.

🧾Fed and Trump Face-Off Intensifies

Amid the chaos, President Trump fired BLS head Erika McEntarfer, accusing her of politically “rigging” the job numbers—and installed a temporary replacement immediately Quartz+6businessinsider.com+6Vanity Fair+6.

This move stirred bipartisan backlash. Senior Republican senators warned it threatened the credibility of U.S. economic statistics The Washington Post+2The Guardian+2businessinsider.com+2.

Meanwhile, the Federal Reserve maintained rates at 4.25–4.50%, as Chair Jerome Powell resisted political pressure for a rapid rate cut thetimes.co.ukReuters.

CME FedWatch data spiked: now estimating ~80% odds of a September rate cut based on the weak labor report Reuters+1CBS News+1.

Impact:

- Bond yields dropped as investors scrambled toward safety.

- The dispute over Fed independence vs political interference ratcheted up tensions.

- U.S. credibility—even for economic data—came under global scrutiny.

Key Takeaway

The labor data added fuel to speculation of an upcoming Fed pivot. But the president’s interference in statistical agencies raised questions about economic messaging.

🧾 Why This Matters to India and Global Markets

Here are four real-world takeaways for Indian readers and global investors:

| Trigger | What It Means in India |

| Weak U.S. jobs data | Lower Fed rates → U.S. bond yields fall → rupee weakens → pressure on Indian ETFs |

| Elevated tariffs | Disrupted global supply chains → Indian exporters benefit or struggle depending on industry |

| Fed uncertainty | Foreign investors may rotate into Indian debt if policy clarity emerges |

| Statistical credibility hit | Increased volatility in global markets driven by distrust in U.S. macro numbers |

Case study:

Indian auto parts manufacturers exporting to the U.S. may face rising costs due to tariffs—or find new demand from companies relocating lines from China or Canada. But exchange turbulence can eat into margins fast.

Key Takeaway

India’s markets aren’t isolated—global ripples land here quickly. Knowing both Fed cues and trade impact allows smarter positioning as an investor or entrepreneur.

🧾 What Experts Are Saying (Global Sources)

- According to Reuters, the selloff stemmed from weak payrolls, Amazon’s poor earnings, and tariff shock—Dow dropped 633.77 pts, S&P off 1.70%, Nasdaq down around 483 pts (~2.29%) Axios+12Quartz+12The Washington Post+12Reuters.

- The Washington Post called the move to fire the BLS boss a metaphorical act of “smashing a bathroom scale” to avoid facing unpleasant truths The Washington Post.

- Axios flagged that the trailing three‑month average job gain plummeted to ~35,000, the slowest since 2010, making the September Fed meeting pivotal Axios.

Key Takeaway

Analysts globally view this as a clear turning point: economic data weaker, markets reactive, and central banks at the crux.

🧾Actionable Tips for Investors

- Reassess risk appetite: Given the volatility, now may be the time to reduce exposure to high‑beta U.S. tech names.

- Watch core sectors: Healthcare, consumer staples, and defensive industries are holding steadier.

- Look at global alternatives: Indian midcaps or undervalued emerging markets may deliver better nearterm returns.

- Watch the Fed calendar: A rate cut signal by early September will be a key pivot.

- Follow currency flows: Rupee movement tied to rate bets and India‑U.S. trade shifts could alter forex strategy.

Metaphor: Think of your portfolio as a vehicle. If the path ahead is rocky (market volatility), you slow down or switch lanes into smoother terrain rather than speeding forward blind.

Key Takeaway

Stay nimble. Use this period to reposition your portfolio toward resilience amid global uncertainty.

Final Thoughts & CTA

This market tumble wasn’t just another bad day—it was a turning point. When jobs grow at a crawl, tariffs ramp up, and the Fed resists political pressure, you’ve got the perfect storm for volatility.

What tweak will you make to your portfolio, strategy or side hustle in light of this shake-up? Share your thoughts below—I’d love to hear whether you’re pivoting to bonds, rupee plays, or defensive stocks.

🗣️ Let’s start the conversation.

Will the Fed cut interest rates due to this report?

Odds of a September rate cut surged to ~80% after the weak jobs data.

How do U.S. tariffs affect Indian exporters?

Higher U.S. duties may disrupt supply chains or open new trade lanes depending on your sector.

Why did the Dow fall 600+ points on August 1, 2025?

A weak 73,000‑job July payroll report plus heavy new U.S. tariffs spooked investors.

What does downward revision of May–June jobs mean?

It shows hiring had been overstated—labour growth is weaker than thought.

Should I sell U.S. tech stocks now?

Consider shifting to defensive sectors if exposed—tech volatility just spiked.