Foreign portfolio investors (FPIs) extended their selling streak of Indian equities for the eighth straight session on Wednesday. The overseas investors offloaded stocks worth approximately Rs 1,605.20 crore, according to provisional data from the National Stock Exchange (NSE). Domestic institutional investors remained buyers for the 27th session and mopped up equities worth Rs 2916.14 crore.

Market Trends

On Tuesday, FPIs sold stocks worth Rs 2,327.09 crore while DII had purchased equities worth Rs 3,845.87 crore. Monday’s session saw the overseas investors offloading Indian equities worth nearly Rs 2,831.59 crore while DII had purchased equities worth Rs 3,845.87 crore.

Monthly Trends

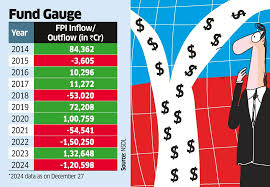

Last month, FPIs sold stocks worth Rs 23,885 crore, according to National Securities Depository Ltd., while they have offloaded shares worth a total of Rs 1.58 lakh crore till now in 2025.

Market Indices

On Wednesday, the benchmark indices snapped their eight-day losing streak and ended in green. Nifty 50 settled 0.92% higher at 24,836.30 while Sensex ended 0.89% higher at 80,983.31. All sectoral indices gained except for Nifty PSU Banks.

The Indian Rupee closed 9 paise stronger at 88.69 against the greenback, according to Bloomberg data.

Expert Insights

‘Opening on a positive note, the index maintained its upward momentum through most of the session, with intraday dips being bought into, ultimately closing with healthy gains. Sentiment was further buoyed by the central bank’s proposals on capital market lending and banking operations’, stated Bajaj Broking Research.

While Indian equity markets will remain closed on Thursday for Dussehra and Gandhi Jayanti, Siddhartha Khemka, head of research, wealth management, Motilal Oswal Financial Services expect positive momentum to sustain on Friday, supported by an accommodative monetary policy, favourable monsoon season and festive-led boost in demand.

Investor Outlook

Investors are advised to remain cautious and keep a close eye on the market trends. The ongoing selling streak by FPIs may have a negative impact on the market, but the buying trend by DIIs is a positive sign. It is essential to keep a long-term perspective and not make any impulsive decisions based on short-term market fluctuations.

For more information on the Indian stock market and to stay updated on the latest news and trends, click here.

Frequently Asked Questions (FAQs)

- What is the current trend of Foreign Portfolio Investors (FPIs) in the Indian stock market?

FPIs have been net sellers for the eighth consecutive day, offloading stocks worth approximately Rs 1,605.20 crore on Wednesday. - How have Domestic Institutional Investors (DIIs) been performing in the Indian stock market?

DIIs have been net buyers, purchasing equities worth Rs 2916.14 crore on Wednesday, marking their 27th consecutive buying session. - What was the impact of FPI selling and DII buying on the Indian stock market indices?

Despite FPI selling, the benchmark indices snapped their eight-day losing streak and ended in green, with Nifty 50 settling 0.92% higher and Sensex ending 0.89% higher. - What are the expert insights on the current market trends and future outlook?

Experts expect positive momentum to sustain, supported by an accommodative monetary policy, favourable monsoon season, and festive-led boost in demand, but advise investors to remain cautious and keep a long-term perspective. - What is the total amount of stocks sold by FPIs in the Indian market so far in 2025?

FPIs have offloaded shares worth a total of Rs 1.58 lakh crore till now in 2025, with Rs 23,885 crore sold last month alone.

Leave a Reply