Do you secretly want to fail at trading? Learn how fear of success, emotional sabotage, and mindset traps ruin Indian traders—and how to fix it. “Kya main khud ka dushman hoon?” This was Ravi’s thought after blowing up his third trading account. He was smart, well-read, had the right tools—yet something inside kept pulling him back. If you’re an Indian trader between 30–45, working hard to break through but keep slipping up, chances are… it’s not the market—it’s you.

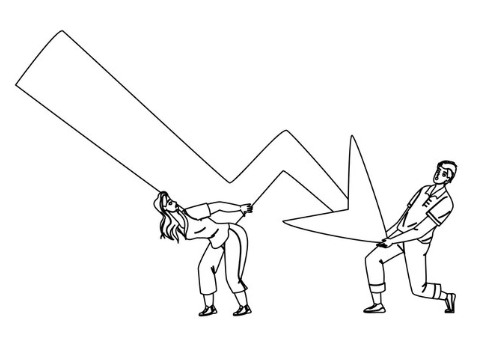

Do you secretly want to fail? As strange as it sounds, many traders unknowingly sabotage their own growth. It’s not always because of lack of skill—but because of deeply buried emotional patterns, fear of success, or subconscious loyalty to family limitations.

In this blog, we’ll unpack this hidden enemy within, and show you how to trade with clarity, calm, and conviction.

🎯 Are You Subconsciously Sabotaging Your Trading?

do you secretly want to fail

You’re not alone if you’ve ever wondered: Why do I keep making the same mistakes, even when I know better? This could be subconscious self-sabotage—a hidden desire to fail that shows up in surprising ways.

Common Signs You Might Be Your Own Worst Enemy:

- You panic and exit good trades early

- You ignore your trading plan despite having one

- You feel guilt when a trade goes well

- You risk more when you’re angry or stressed

- You avoid journaling or reviewing losing trades

Many of these behaviors stem from inner conflicts like:

- Fear of success: Success may mean new pressure, visibility, or responsibility.

- Family loyalty: Some traders subconsciously don’t want to “do better” than their parents.

- Fear of change: Growth means stepping into the unknown—something the brain resists.

🔁 “Sometimes, the fear of success is bigger than the fear of failure.” – Dr. Gay Hendricks

Mindset Shift:

Trading is not just about strategies. It’s about resolving the emotional tug-of-war inside you. The moment you allow yourself to succeed, your trading can transform.

🧠 Trading With Money You Can Afford to Lose – Why It Matters

trade only with money you can afford to lose

Imagine playing cricket knowing you won’t lose your wicket if you make one bad shot. That freedom changes how you play.

The same goes for trading.

Why Trading With Risk Capital Is Essential:

- Removes emotional attachment to trades

- Enhances focus and calm decision-making

- Prevents revenge trading or panic exits

- Builds psychological resilience

Real-Life Analogy:

Ravi used his emergency savings for a big Nifty options trade. The result? Sleepless nights, emotional exits, and heavy losses. When he switched to a fixed “trading risk capital” pool, his performance stabilized.

Actionable Tips:

- Allocate a separate trading capital (never touch rent/EMI money)

- Accept: Losing is part of the game.

- Use position sizing so that no single trade wipes out your account

⚠️ Emotionally charged capital = Poor trading decisions.

😴 Why Trading While Tired is a Recipe for Disaster

Secondary Keyword: don’t miss sleep

Ever tried placing trades after a long day at work? Your brain is foggy, attention span is low, and frustration tolerance is zero.

Trading requires:

- Focus

- Patience

- Fast reactions

All of these vanish when you’re sleep-deprived.

Desi Life Parallel:

If you wouldn’t drive from Delhi to Jaipur overnight without rest, why would you trade mentally exhausted?

Mindset Shift:

Your energy is your edge. Sleep isn’t a luxury—it’s a trading tool.

Quick Tips:

- Sleep at least 6–8 hours before trading days

- Avoid screen exposure right before bed

- Don’t trade on days you wake up foggy or irritable

🧘♂️ “The more rested you are, the less you react. And trading is 80% emotional regulation.”

📊Don’t Trade by the Seat of Your Pants – Use a Plan

don’t trade without a plan

Many Indian traders treat the market like a game of teen patti—improvising as they go. But trading isn’t jugaad. It’s a skill-based discipline.

Problems Without a Plan:

- You don’t know when to enter or exit

- You second-guess mid-trade

- You let emotions take over

- You chase FOMO setups

Solution: Build a Simple, Repeatable Trading Plan

Include:

- Entry rules

- Stop-loss levels

- Target exits

- Risk per trade

- Daily loss limits

Case Study:

Priya, a part-time trader from Pune, used to jump into trades after watching YouTube tips. After documenting a rules-based swing strategy, her win rate and confidence went up.

🎯 “A plan brings peace. Emotion thrives in uncertainty.”

🧠 What You Should Remember:

- Think before you trade

- Simplicity wins—use clear rules

- Follow the plan even after a losing streak

💥 Why Some Traders Fear Success More Than Failure

fear of success

Strange but true—some traders panic when things go too well. Why?

Common Reasons:

- Guilt over outshining family or peers

- Fear of responsibility that comes with consistent profits

- Fear of losing the lifestyle that comes with mediocrity

Example:

Ajay started earning consistently from intraday trading. Instead of scaling, he began making reckless trades. Deep down, he felt unworthy of success. Therapy and journaling helped him work through it.

How to Overcome Fear of Success:

- Visualize success as freedom, not burden

- Affirm your worthiness to win

- Track self-sabotaging patterns

- Replace guilt with gratitude

💡 “Success doesn’t change you—it reveals who you are underneath.”

⚠️How to Stop Being Your Own Worst Enemy in Trading

emotional trading, avoid trading mistakes, psychological traps, trading mindset

Bulletproof Your Trading Psychology:

✅ Journal Every Trade – Capture thoughts, emotions, and mistakes

✅ Use a Checklist – Reduce impulsive trades

✅ Have a ‘Cool-Off’ Button – Step away after 2 losses

✅ Practice Emotional Awareness – Name what you feel: fear, greed, boredom, hope

✅ Celebrate Process Over Outcome – Focus on correct execution, not profit

Mindset Shift:

Every trader makes mistakes. But repeating them is a choice. Awareness is your first superpower.

🧘♂️ “The goal is not to trade perfectly. It’s to trade consciously.”

🔑 Quick Takeaways

- You might fear success without realizing it

- Trading tired leads to emotional errors

- Never trade with money you can’t afford to lose

- A written plan beats gut feeling every time

- Self-awareness is the #1 trading edge

🏁 Conclusion: Set Yourself Free

You don’t have to be your own worst enemy. You don’t have to carry the emotional baggage of guilt, fear, or invisible pressure. You’re allowed to succeed. You’re allowed to grow.

By trading only what you can afford to lose, staying emotionally sharp, and following a clear plan, you give yourself the best chance—not just to trade well, but to evolve as a person.

💬 Have you ever sabotaged a trade emotionally? Share your story in the comments. Let’s grow together.

📣 Call to Action:

👉 If this resonated with you, share it with a fellow trader who needs this wake-up call.

📩 Subscribe to our newsletter for more emotionally intelligent trading wisdom tailored for Indian market learners.

Why do I repeat the same trading mistakes even after learning strategies?

Because the real problem may be emotional, not technical. Patterns come from subconscious beliefs.

How can I stop sabotaging my trades emotionally?

Use journaling, rest properly, trade with risk capital, and follow a written plan consistently.

What if I fear success in trading?

You’re not alone. Address guilt or fear through introspection, therapy, or coaching.

Is lack of sleep really that bad for trading?

Yes. Poor sleep leads to emotional volatility and cognitive fatigue. Alertness is essential for precision.

Why is a trading plan so critical?

It reduces emotional decisions, provides clarity, and improves long-term consistency.