Last date to file ITR for FY 2024‑25 (AY 2025‑26) for non‑audit taxpayers is extended to 15 Sept 2025. Belated ITR due by 31 Dec 2025. Updated ITR‑U until Mar 2030.

Imagine discovering in August that the July 31 ITR deadline has quietly slipped past you. Heart racing, forms unfinished, deadline looming—every hour feels like ticking tax time‑bomb. Welcome to the relief: the ITR deadline for taxpayers who don’t require audit (mostly salaried individuals and HUFs) has been extended to 15 September 2025. (Primary Keyword: last date for filing ITR for taxpayers not requiring audit)

That’s right—if your annual income isn’t subject to audit, including many salaried employees, you now have additional time to breathe, prepare, and file accurately. But what about belated returns or updated ITRs (ITR‑U) if you make errors later? This guide breaks it all down with examples, FAQs and expert clarity—written by your tax‑savvy friend, not a robot.

📚 Body

⏳ Last Date for Filing ITR (Non‑Audit Taxpayers)

- Original due date: 31 July 2025.

- Extended due date: 15 September 2025, granted by CBDT to ease logistics after ITR form/capital gains revisions and delayed TDS credit updates The Economic Times+15ClearTax+15apkireturn.com+15The Economic Times+9https://www.taxmann.com+9vjmglobal.com+9SAP TAX HUB LLP+3helptax.in+3taxhelpdesk.in+3taxhelpdesk.in+14TAXCONCEPT+14ClearTax+14The Economic Times+1.

Example: Riya, a W‑2 employee, discovered late when ITR‑1 utility came out late. With this relief she comfortably files by 10 Sept without penalty.

Key takeaway: If you don’t require audit, mark 15 September 2025 as your final filing day.

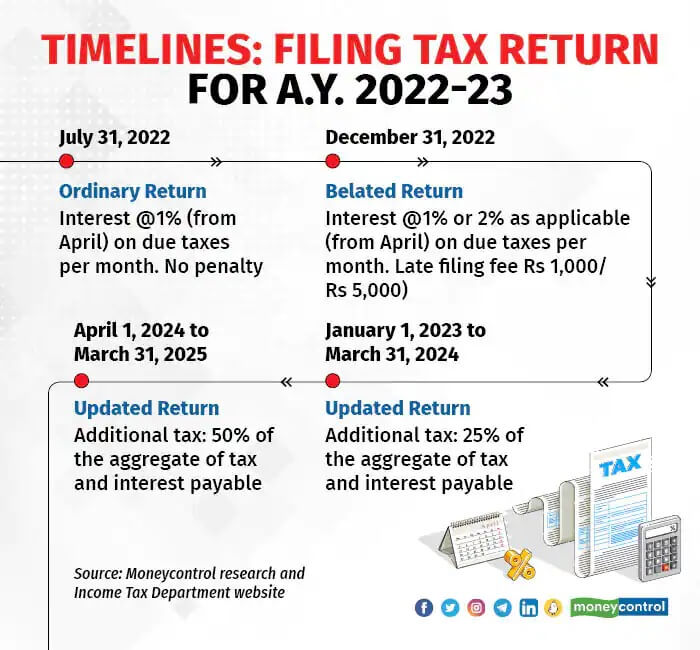

🕒 Belated (Late) & Revised Returns – Where Do They Fit?

- If you miss 15 September, you can still file a belated or revised return by 31 December 2025—subject to penalties and interest Hindustan Times+9SAP TAX HUB LLP+9TAXCONCEPT+9.

- Penalty under Section 234F:

- ₹1,000 if your total income ≤ ₹5 lakh

- ₹5,000 if income > ₹5 lakh SAP TAX HUB LLP+5adroitfinancial.com+5apkireturn.com+5.

- ₹1,000 if your total income ≤ ₹5 lakh

- Interest (Section 234A): 1 % per month or part‑month on unpaid tax until filing The Economic Times+15adroitfinancial.com+15helptax.in+15.

Story: Arun filed on 20 Oct and paid penalty ₹5,000. He still claims investment deductions but misses loss‑carry‑forward rights.

Key takeaway: Late returns are allowed but costly and may lose some tax benefits. File before 31 December 2025.

🔄 Updated Returns (ITR‑U) – Fixing Big Omissions

- ITR‑U gives extra time—up to 48 months from the end of the assessment year.

- For AY 2025‑26, last date = 31 March 2030 taxhelpdesk.in+5helptax.in+5apkireturn.com+5ClearTax+15SAP TAX HUB LLP+15helptax.in+15.

- Introduced in the Budget 2025 revision, replacing earlier 24‑month window to correct serious omissions like unreported income or TDS mismatches.

Example: Priya missed reporting rental income in her ITR filed by Dec 2025. She files ITR‑U in Feb 2028 to include it properly—loss of carry‑forward rules avoided.

Key takeaway: If you missed something major, ITR‑U until March 2030 is your fallback—not belated ITR.

🧾 Who Gets Which Deadline & Why the Extension?

- Non‑audit taxpayers, including salaried individuals, pensioners, HUFs: extended to 15 Sept 2025 The Indian Express+6TAXCONCEPT+6IndiaFilings+6.

- Audit‑required taxpayers (businesses, professionals with income above threshold): deadline remains 31 Oct 2025.

- Transfer‑pricing / international transactions: 30 Nov 2025 final filing date blog.taxvic.com+1Stable Money App+5SAP TAX HUB LLP+5The Indian Express+5.

Why the extension?

- Structural changes to ITR forms under Budget 2024 (capital‑gain reporting, slab rewriting)

- Delay in TDS credit updation after 31 May 2025

- Need to test updated e‑filing utilities for AY 2025‑26 The Indian Express+5ClearTax+5IndiaFilings+5IndiaFilings+1.

Key takeaway: Extension applies only to non‑audit taxpayers. Audit‑cases must follow standard dates.

✅ Planning Tips & Mistakes to Avoid

- Calculate tax and pay self‑assessment tax by 31 July 2025, even if filing later, to avoid interest under Sec 234A Hindustan Times.

- Verify ITR after filing, or it won’t count as filed. E‑verification within 30 days is mandatory.

- Double‑check your ITR form: Use ITR‑1 or ITR‑2 per your income profile.

- Watch common errors: wrong PAN/DOB, omission of income (interest, rent, capital gains), claim mismatches.

- Avoid rushing in late September: Filer crowd and system loads may delay verification or processing.

- Maintain records if you plan to claim deductions (80C, HRA, etc.) or switch tax regime.

Key takeaway: Timely tax payment, correct ITR form, e‑verification and document backup can save costly mistakes.

📣 Call to Action

Have you filed your ITR yet? If not, are you planning to use the extended deadline or waiting till December? Share your experience or questions in the comments—your peers might find it helpful!

🧠 Recap Summary

- Non‑audit taxpayers now have until 15 Sept 2025 to file ITR for FY 2024‑25 (AY 2025‑26) blog.taxvic.comblog.taxvic.com+8IndiaFilings+8The Economic Times+8Compliance Calendar LLP+9helptax.in+9The Economic Times+9The Economic Times+6adroitfinancial.com+6apkireturn.com+6apkireturn.com+2TAXCONCEPT+2TAXCONCEPT+2The Economic Times+2.

- Belated or revised return may be filed until 31 Dec 2025, but penalties apply SAP TAX HUB LLP+1.

- Updated return (ITR‑U) can be filed up to 31 Mar 2030 for serious corrections The Economic TimesSAP TAX HUB LLPtaxhelpdesk.in.

Leave a Reply