Ever found yourself in a situation where your gut feeling just felt right, even when your logical mind said otherwise? In trading, this dilemma can be a double-edged sword. Trusting your intuition in trading can lead to success, but it can also backfire if your instincts are clouded by emotions or inexperience.

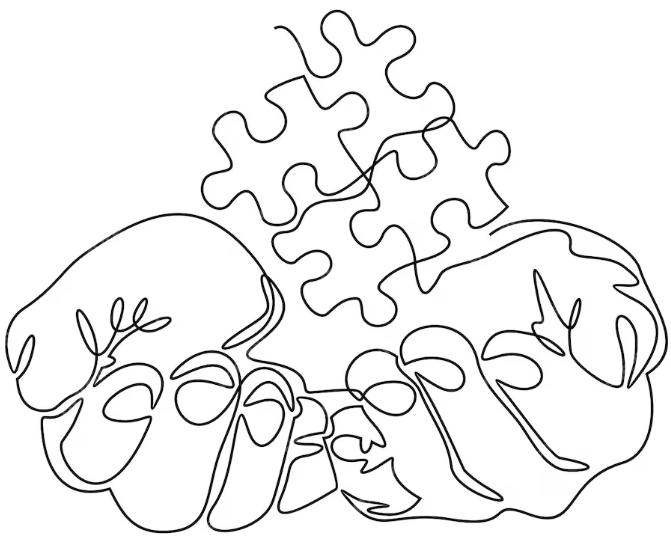

There’s a fine line between intuition and logic in trading. While seasoned traders may have developed an intuitive edge, novice traders often fall into the trap of letting emotions drive their decisions. Understanding when to rely on intuition and when to stick to logic is a crucial skill that separates successful traders from those who struggle.

Intuition vs. Logic in Trading: Striking the Right Balance

- Define intuition and logic in the trading context.

- Real-life trading example: Making a quick decision based on a gut feeling.

- Explain why intuition can be misleading, especially for beginners.

- Introduce the concept of pattern recognition.

Emotional Trading Mistakes: How Intuition Can Lead You Astray

- Case study: The Jellybean Experiment (Drs. Denes-Raj and Epstein).

- Breakdown of why intuition overpowers logic.

- Real-life trading mistake: Ignoring risk because of a strong hunch.

Trading Psychology for Beginners: Building the Right Mindset

- Discuss how emotions influence trading decisions.

- Techniques to manage impulsive decisions.

- Stories of experienced traders who developed intuition over time.

Risk Management in Trading: Why Logic Should Prevail

- Highlight the importance of risk management over gut feelings.

- Practical tips for novice traders to minimize risks.

- Callout: Stay cautious and disciplined during your learning phase.

Developing Intuitive Skills in Trading: Learn Before You Leap

- How to cultivate intuitive trading skills through experience.

- Balancing analysis with instinct.

- Advice from professional traders.

🔑 Quick Takeaways

- Trust your instincts, but validate with data.

- Never abandon risk management rules.

- Intuition improves with practice and experience.

Leave a Reply