“Learn how much that stock should be in your portfolio—smart, personalized allocation guide for Indian investors.”

Ever caught yourself staring at your stock portfolio and wondering, “Should I really have this much riding on that one stock?” That nagging question is more common than you’d think—and tackling it is where smart investing begins.

Let’s talk about how much should this stock be in your portfolio—because stacking too much on one name can feel like riding a two-wheeler on a cricket pitch: thrilling, but risky.

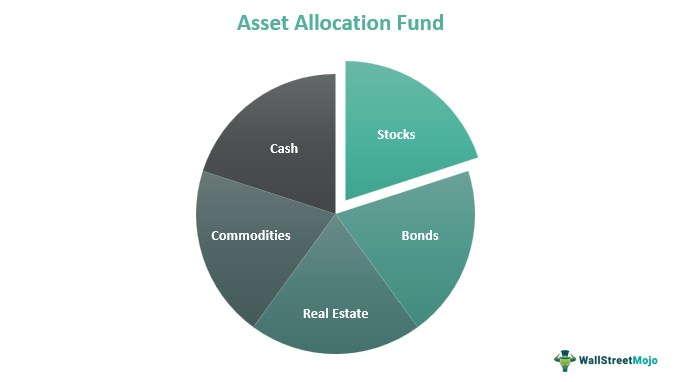

Portfolio Diversification in India

When you put too much into one stock, you’re riding in a rickshaw trying to balance your grocery bag and a crate of eggs—one bump and—well, you know. That’s why spreading your bets across sectors and securities helps keep your basket intact.

- Indian households often hold 3–5 stocks directly alongside mutual funds and fixed deposits.

- A well-diversified portfolio typically caps any single stock at 5–10% of total equity exposure.

- If your portfolio is ₹10 lakh of equities, and you have ₹20,000 (2%) in a mid-cap company—that’s likely comfortable; 20%? Unstable.

Summary: Stick to a reasonable cap—like 5–10%—for single stocks. It keeps your financial rickshaw steady.

Calculating Ideal Stock Allocation

How do you land on that sweet spot? Here’s a practical framework:

- Determine your overall equity allocation.

- If you’re 30 years old, maybe it’s 80% equities, 20% bonds/liquid funds.

- If you’re 30 years old, maybe it’s 80% equities, 20% bonds/liquid funds.

- From your equity chunk, decide a single-stock threshold.

- Risk-tolerant? Maybe you go up to 10%. Conservative? 3–5%.

- Risk-tolerant? Maybe you go up to 10%. Conservative? 3–5%.

- Consider correlation.

- If your other holdings are also in banking, don’t overweight SBI and HDFC simultaneously.

- If your other holdings are also in banking, don’t overweight SBI and HDFC simultaneously.

- Account for conviction and research.

- High conviction backed by earnings clarity? Okay, dial slightly higher—but not reckless.

- High conviction backed by earnings clarity? Okay, dial slightly higher—but not reckless.

H3 Summary: Start with your total exposure to stocks, then cap each holding based on risk appetite, convictions, and sector weight.

Risk Appetite and Allocation

Think of your risk appetite as your cup of chai. Some like it mild, some like it strong, some can’t handle masala. Your stock allocation should feel like your perfect brew—not burning, but comfortingly robust.

Indian Scenario Examples:

- Young Professional (25–35, aggressive):

Equity-heavy, comfortable with 8–10% in top picks like Infosys or Reliance. - Mid-career (35–45, balanced):

Trim single stocks to 5–7%. Broaden to ETFs, mid-caps, and sectoral mutual funds. - Near-retirement (45+, cautious):

Keep single-stock exposure under 5%; focus on large-caps and stable multinationals.

Common Mistakes:

- Letting emotions crowd judgment. (“That stock soared—I need more.”)

- Failing to account for correlation. (“All tech picks—I didn’t realize they move together.”)

- Ignoring portfolio drift. (“That 5% grew to 15%—now it’s the biggest risk.”)

Summary:Tailor allocation to your stage of life and mindset. Don’t let emotion or success creep become your enemy.

Rebalancing Strategies

Imagine your portfolio is a car on a highway. Occasionally, you need to steer back when the cruising path drifts. That’s rebalancing.

- Time-based rebalancing: Quarterly or semi-annual check.

- Threshold-based: If a single stock hits, say, +50%, trim it to your original allocation.

- Event-driven: After a hefty dividend payout or surprising earnings.

In India, consider tax implications. Reducing a large-cap that’s popped may rescue gains, but can invite short-term capital gains tax. Pair rebalancing with tax-efficient timing, like harvest losses elsewhere.

Summary: Set rules—calendar or thresholds—to rebalance. Avoid emotional adjustments; stick to calm, planned steering.

Real-World Case Study: Reliance Industries

Let’s say you believed in Reliance during its digital pivot. You bought ₹50,000 worth when your equity portfolio was ₹5 lakh (1%). Over time, it grew to ₹1 lakh—that’s 2%.

- Was this healthy growth? Yes—your portfolio outgrew proportion, but deliberately.

- Next step? Either leave it—if conviction is strong—or trim excess and rotate into other sectors like power or consumer goods.

- PTSD (Post-Trade Syndrome) check: Don’t rush. If trimming, plan the sale over days to avoid market impact.

Summary:Let winners run—but not indefinitely. Keep allocation in check, consider profit booking, stay mindful of tax and conviction.

Metaphor Time: Your Portfolio as a Thali

Imagine your portfolio is a masala thali—many small portions rather than one giant dish.

- One dosa (stock) dominating isn’t satisfying; you’ll crave balance.

- A mix of yummies—dal, rice, sabzi, chutney (stocks, ETFs, bonds, gold)—makes a hearty feast.

- If the dosa size grows too big, everything else loses flavor and nutrition.

The goal: A balanced, tasty thali that nourishes even when one dish fluctuates.

Actionable Tips—Fast & Feisty

- Use 5–10% of equity exposure as a rule-of-thumb per stock.

- Rebalance quarterly—or when a stock runs up by 30–50%.

- Watch sector weight—don’t let multiple holdings concentrate risk.

- Stay clear of emotional decisions—set and follow allocation rules.

- Use SIPs or staggered exits to manage timing and tax.

Section Wrap-Up Quotes

“Rule of Thumb: No more than 5–10% per stock keeps your portfolio grounded.”

“Let Winners Run… But Not Wildly: If it’s doubled, trim back to your planned level.”

“Thali Thinking: A vibrant mix of investments is more nourishing—and stable—than a single heavyweight.”

Call to Action

How balanced does your portfolio thali look? Are you tempted to overinvest in your favorite stock, or play safe with lower exposure? Share your thoughts or questions—I’d love to hear your investing flavor!

Final Word

This blog isn’t about dictating a one-size-fits-all number. It’s about giving you a framework—and a bit of that human cooking flair—to decide for yourself how much that stock deserves in your portfolio. With clear rules, regular rebalancing, and wise seasoning, your investing thali can remain rich, resilient, and wholly satisfying.

How does sector exposure affect stock weight?

Multiple stocks in same sector spike correlation risk—balance across sectors.

How much of one stock is safe in my portfolio?

Keep it under 5–10% of your equity exposure to reduce single-stock risk.

When should I rebalance my portfolio?

Rebalance quarterly or when a holding drifts 30–50% away from its target weight.

Does conviction allow higher allocation?

Only if backed by research and diversification—beware emotional bias.

What metric guides real-world rebalancing?

Use fixed percentages and threshold rules, not gut instincts, for clarity and discipline.